‘Sustainable development’ (‘sustainability’ for short) was well-defined in 1972 by the Bruntland Commission as “development that meets the needs of the current generation without compromising the ability of future generations to meet their own needs”.

The 'triple bottom line'

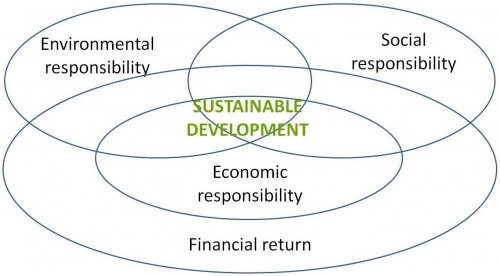

It was usefully made applicable for the business community by the phase the ‘Triple Bottom Line’ and the Venn diagram that shows the need to balance environmental, social and economic factors.

However, further consideration reveals that this three-way balance still falls short of describing what companies need to do.

The 'quadruple bottom line'

Companies need to make four returns, to the environment, to society, to the economy AND, a financial return, to shareholders. This is a quadruple bottom line. For too long, companies and investors have conflated the meaning of ‘economic’ and ‘financial’ returns.

The ‘financial’ return is the return that companies make to shareholders in terms of capital growth and dividends (this is well understood)

The ‘economic’ return, by contrast, is the return that a company makes to the (national or local) economy in terms of its promotion of economic growth, stability, productivity and competitiveness in the markets within which they operate. (this is rarely effectively understood or reported)

Consider the question over the expansion of airports – the debate is between the level of economic benefit that larger airports bring (or don’t) with the level of environmental damage that they cause. The financial benefit to the airlines or the airport operators is a separate question.

If a further example is needed, consider the recent failure of the banking system. For years, banks had focussed on the returns to shareholders (their financial responsibilities) but had forgotten their wider economic responsibilities (to support a functioning economy). The subsequent government intervention is a (belated) recognition that the banks failed to manage the fourth bottom line. Interestingly, SRI investors that do not separate this fourth (economic) bottom line from the first (financial) one would have missed the banking collapse and will miss the next one.

The 'quintuple bottom line'

Finally, companies are obliged to operate within an ethical or moral framework which is likely to be defined by the religious and non-religious beliefs of their wider community – but may have no direct relationship to other social, environmental, economic or financial considerations.

This adds up to a five-way balancing act for companies - a quintuple bottom line!

Or even six?

Some SRI analysts will insist that a companies' corporate governance obligations be placed on a level with their environmental and social obligations (using the phrase 'ESG'). We tend to draw the line at five and argue that corporate governance deals with the management and reporting process rather being something that is to be reported upon.